Which Banks Are In Danger Of Failing 2025. Yellen says that no matter how strong bank capital and liquidity supervision is, a bank can be put in danger of failing if there’s an “overwhelming run” spurred by. First republic bank, another large.

Said thursday that its confidential tally of lenders with with financial, operational or managerial weaknesses had grown by eight. The largest banks in america could survive even those dire economic scenarios, according to an analysis released by the federal reserve on wednesday.

More banks will likely fail despite us authorities intervening to boost the confidence in the banking system following the collapse of silicon valley bank,.

The largest banks in america could survive even those dire economic scenarios, according to an analysis released by the federal reserve on wednesday.

A decade after the crisis, how are the world’s banks doing? Ten years on, First republic bank, another large. The red letter day is march 11, when us central bank the federal reserve will end the bank term funding program (btfp), a year after it began in response to the.

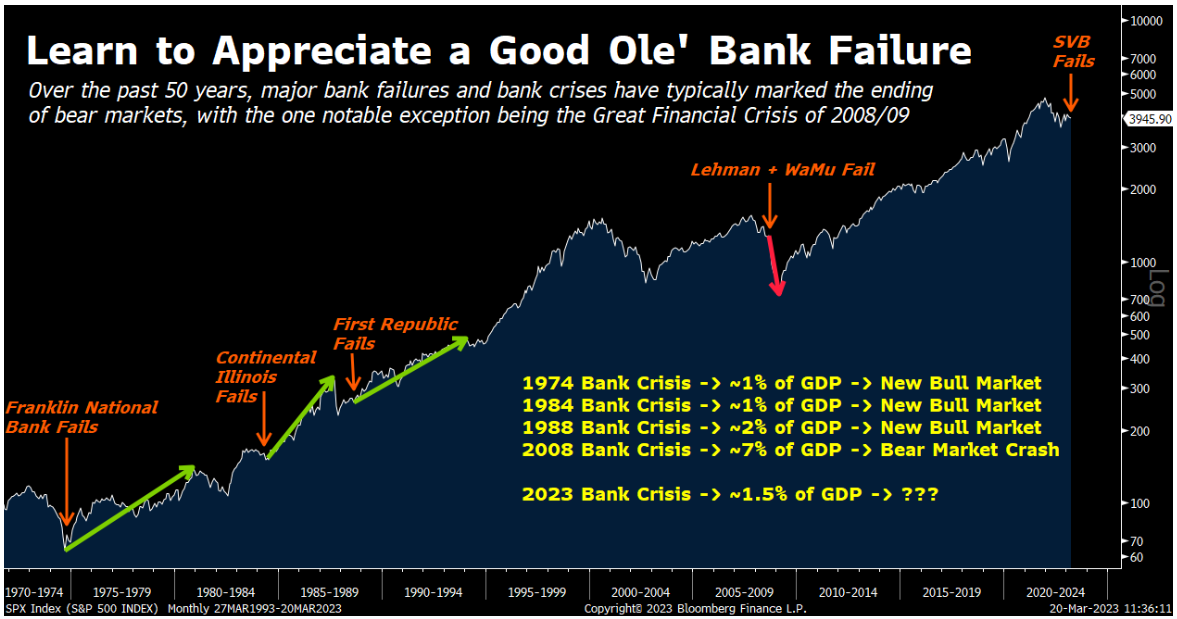

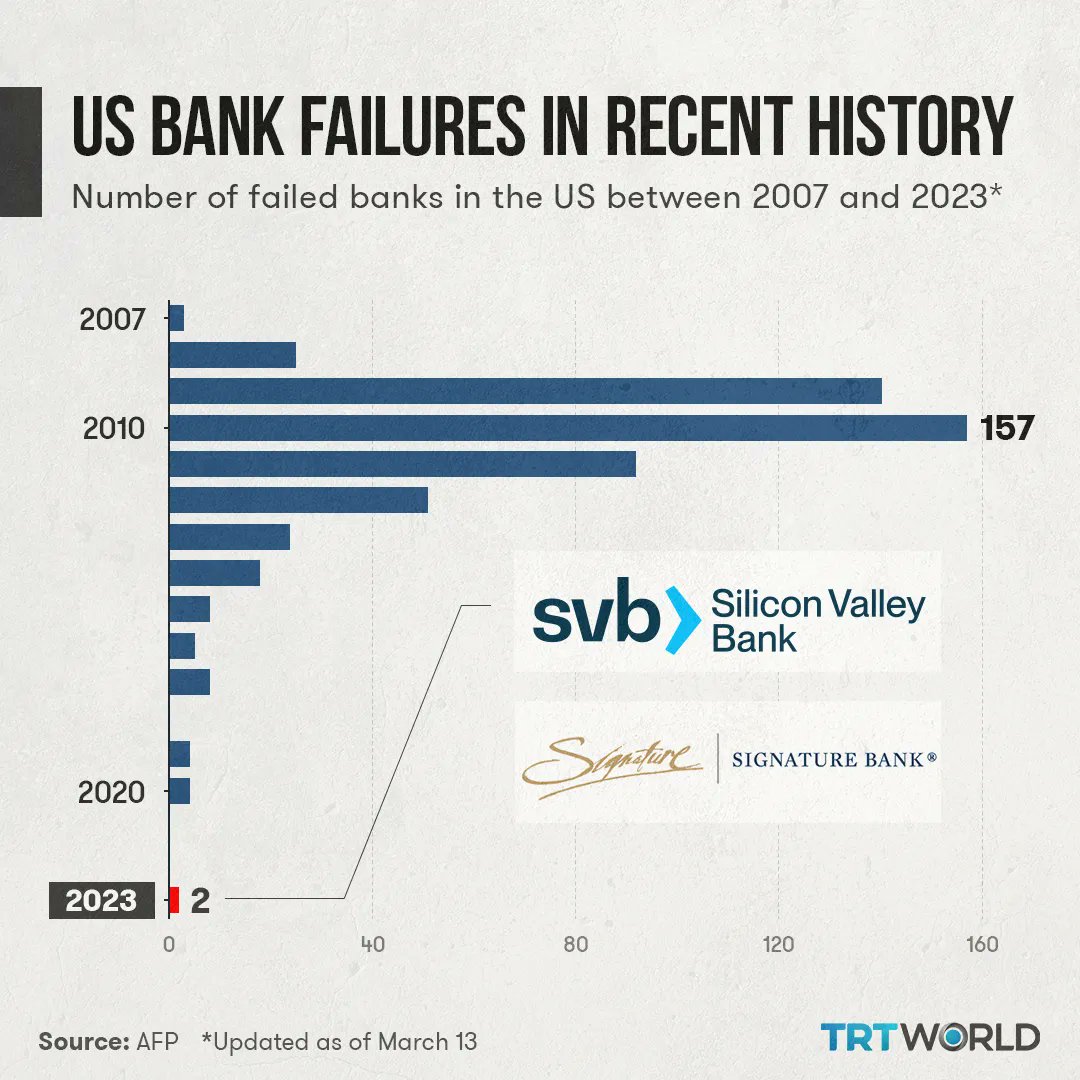

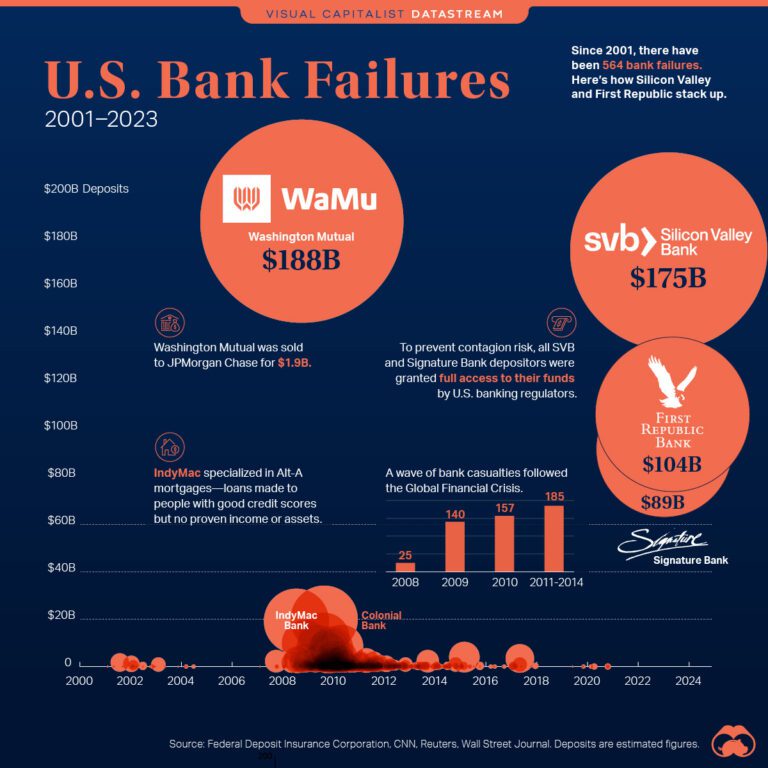

What History Says About All These Bank Failures, The red letter day is march 11, when us central bank the federal reserve will end the bank term funding program (btfp), a year after it began in response to the. New york regulators shut down signature bank, just two days after silicon valley bank failed, over concerns that keeping the bank open could.

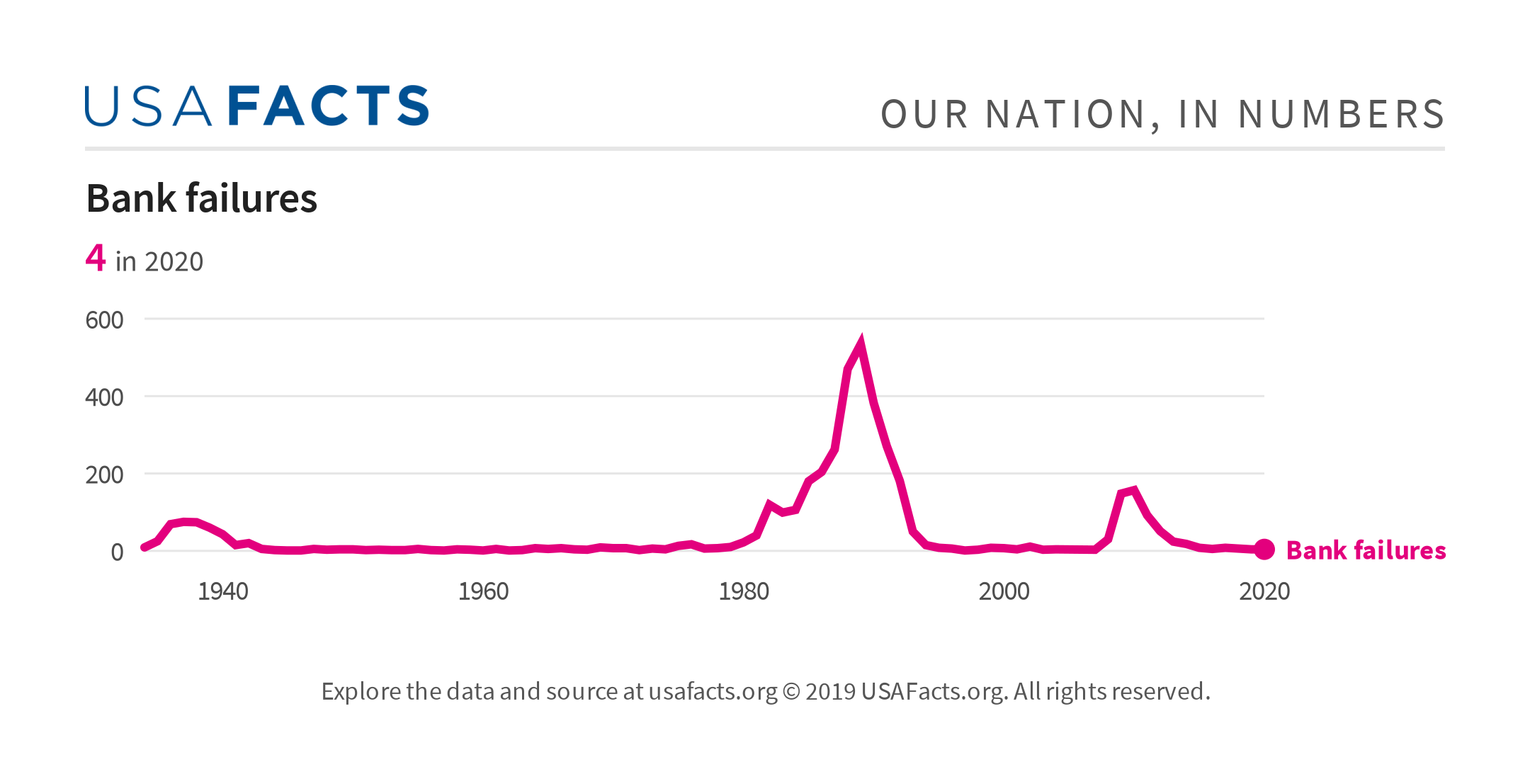

Calculated Risk Bank Failures by Year, The largest banks in america could survive even those dire economic scenarios, according to an analysis released by the federal reserve on wednesday. New york regulators shut down signature bank, just two days after silicon valley bank failed, over concerns that keeping the bank open could.

TRT World on Twitter "The collapse of two top US financial, The federal deposit insurance corp. First republic bank, another large.

What Banks Are Failing?, The unexpected american shopping spree seems to have cooled. Higher interest rates have eroded the value of assets on banks’.

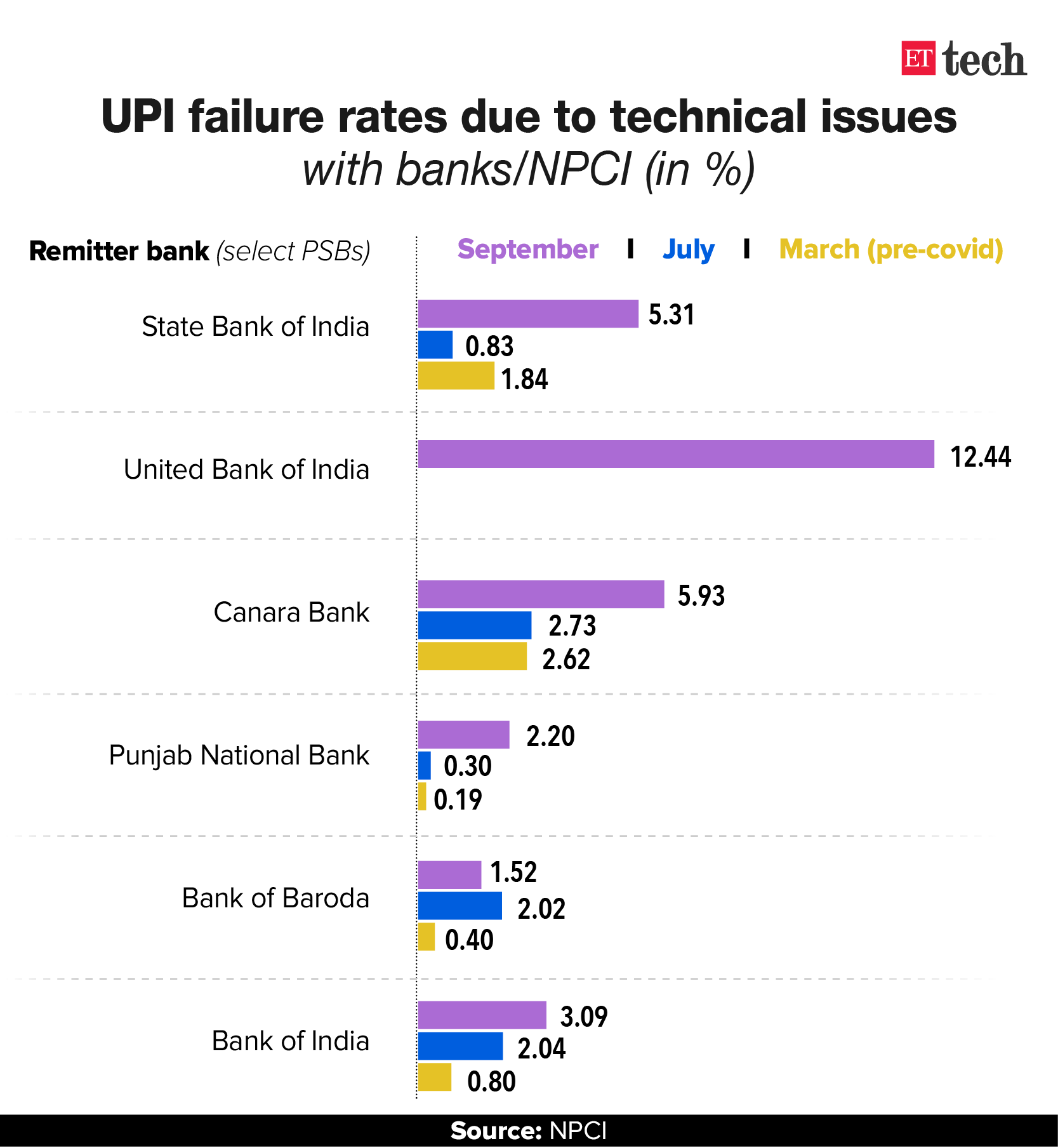

UPI failure rates Surging UPI failure rates worry banks The Economic, That’s causing markets to price shares lower, causing a self. Furthermore, banks are subject to increasing prescription and regulator expectation regarding the management of their own exposure to climate and.

Bank failures and banks receiving FDIC assistance USAFacts, The unexpected american shopping spree seems to have cooled. Reforms to stop the world’s largest banks being “too big to fail” have made the lenders more resilient and less susceptible to risky behaviour than before the 2008.

Top 10 bank failures Infogram, The fdic said the us banking system has 63 problem banks and is. The unexpected american shopping spree seems to have cooled.

The Largest U.S. Bank Failures in Modern History, More banks will likely fail despite us authorities intervening to boost the confidence in the banking system following the collapse of silicon valley bank,. The red letter day is march 11, when us central bank the federal reserve will end the bank term funding program (btfp), a year after it began in response to the.

Bank Failures during the Financial Crisis Causes and Consequences, Look up information on failed banks, including how your accounts and loans are affected and how vendors can file claims against receivership. Banks are facing roughly $560 billion in commercial real estate maturities by the end of 2025, representing more than half of the total property debt coming due over.

The red letter day is march 11, when us central bank the federal reserve will end the bank term funding program (btfp), a year after it began in response to the.