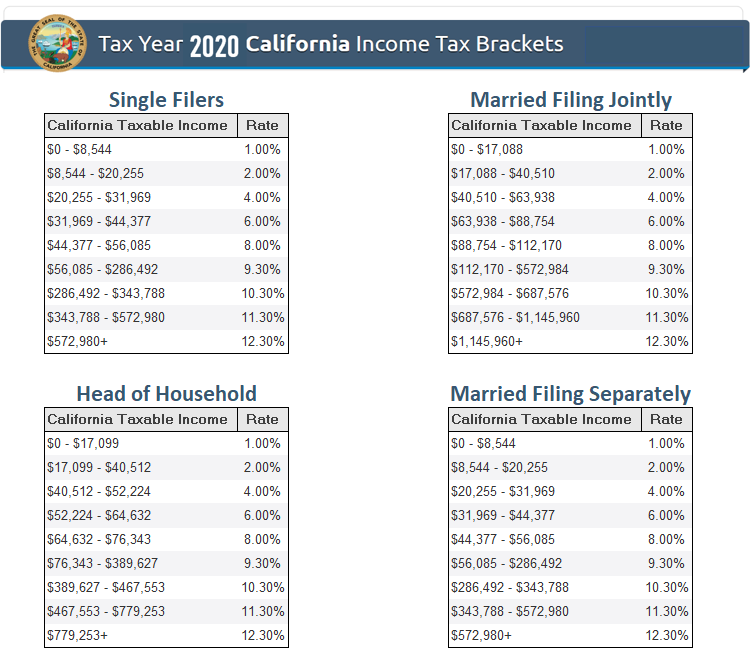

California Tax Brackets 2025 Married Jointly. California has nine tax brackets, ranging from 1 percent to 12.3 percent. See current federal tax brackets and rates based on your income and filing status.

California’s 2025 income tax ranges from 1% to 13.3%. Married/registered domestic partner filing jointly or qualified widow(er)

California State Tax Brackets 2025 Married Jointly Sheri Dorolice, For 2025, the standard deduction for single filers in california is $12,200, and for married couples filing jointly, it's $24,400.

Tax Brackets For 2025 Married Filing Jointly 2025 Niki Teddie, Explore the latest 2025 state income tax rates and brackets.

2025 Tax Brackets Announced What’s Different?, Married/registered domestic partner filing jointly or qualified widow(er)

Tax Brackets 2025 Married Jointly Calculator With Dependents Toma Agnella, What are the california tax brackets 2025?

2025 Married Tax Brackets Married Jointly Calculator Dixie Frannie, Personal exemptions, which were previously available, have been.

Tax Brackets 2025 Federal Irene Leoline, The california standard deduction for 2025 tax returns filed in 2025 is $5,540 for those who are single or married filing separately, and $11,080 for those who are married filing.

Tax Bracket 2025 Head Of Household Married Jointly Sonya Elianore, Explore the latest 2025 state income tax rates and brackets.

2025 Standard Tax Deduction Married Jointly Over 65 Rorie Claresta, See current federal tax brackets and rates based on your income and filing status.

California Tax Brackets 2025 Married Jointly Debbie Simonne, This page has the latest california brackets and tax rates, plus a california income tax calculator.